Introduction – Why Print Checks in QuickBooks Desktop or QuickBooks Online?

Printing your own checks using QuickBooks? Sounds like a botched DIY project waiting to happen, right? Well, think again! Surprisingly, there are actually several benefits to taking matters into your own hands and becoming your very own check-printing mogul. So grab your inner entrepreneur and let’s dive into why printing your own checks using QuickBooks makes sense.

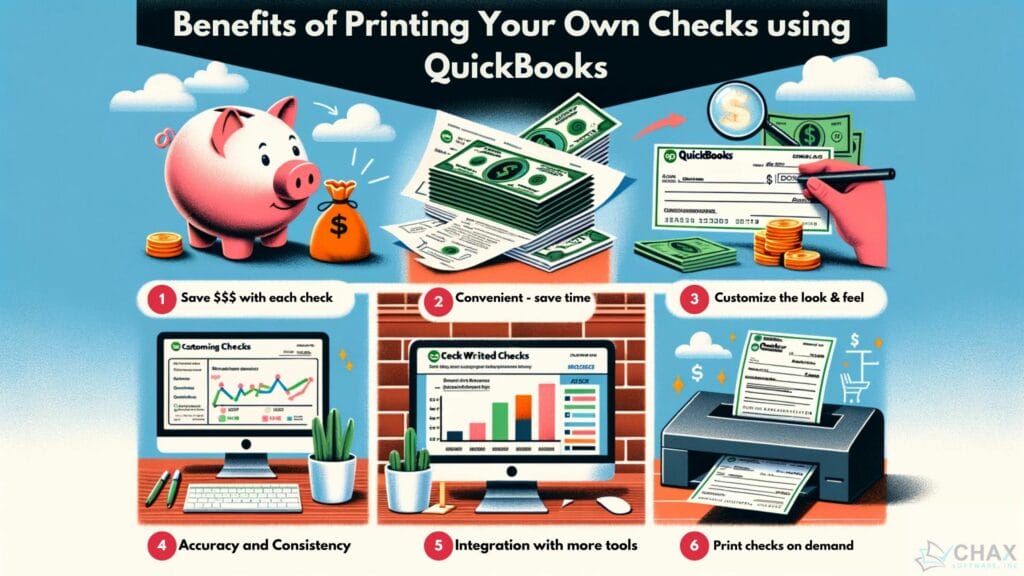

Benefits of Printing Your Own Checks Using QuickBooks

- Saving Money: Let’s face it, checks from the bank or even 3rd party printing services can be expensive, especially if you have a high volume of transactions. By printing your own checks, you can save a significant amount of money in the long run. Who doesn’t want to keep a little extra cash in their pocket? Write and print checks at home or in the office. Need to print your checks the same way banks do? Use a check writing software like MultiCHAX.

- Customization: Printing your own checks allows you to add a personal touch to your business transactions. With MultiCHAX, you can customize the design, add your logo, and even choose different styles and colors. Who knew handling finances could be so stylish? Just choose the check style you wish to print on, use any blank check stock, select checks to print from QuickBooks, add them to the print queue and you are done.

- Convenience: No more waiting in line at the bank or ordering checks that take forever to arrive. With QuickBooks, you have the power to print checks whenever you need them, right from the comfort of your own office. It’s like having a printing press at your fingertips!

- Reduced Errors: We’ve all had those moments of cross-eyed confusion when deciphering someone’s handwriting on a check. By printing your own checks, you eliminate the risk of misreading important information, ensuring that your payments are accurate and error-free. Hello, peace of mind!

Integration with Leading Financial Tools

Not only does QuickBooks allow you to print your own checks, but it also seamlessly integrates with other leading financial tools. This means you can easily keep track of your transactions, manage your accounts, and generate accurate financial reports all in one place. Say goodbye to the headache of juggling multiple systems and hello to streamlined financial management.

So there you have it, my financially-savvy friend. Printing your own checks using QuickBooks Online or QuickBooks Desktop isn’t just a quirky side project, it’s a smart business move. With cost savings, customization options, convenience, and integrated financial tools, you’ll be strutting through the check-writing process like a boss. So go ahead, unleash your inner mogul, and let QuickBooks be the ink to your financial success!

Cost-effectiveness of Printing Your Own Checks Using QuickBooks Desktop / Online

Printing your own checks using QuickBooks offers numerous benefits that contribute to financial optimization and cost-effectiveness. By taking control of your check-printing process, you can save money, streamline operations, and maximize the use of available resources.

Long-term investment

One of the key advantages to create a check yourself is the significant cost savings over time. Traditional check orders from the bank can be expensive, particularly for businesses with a high volume of transactions. By learning how to print checks in QuickBooks Online or Desktop, you can eliminate the need to constantly reorder checks, resulting in considerable long-term cost savings. This extra cash in your pocket can be invested back into your business, ultimately driving growth and profitability.

On-demand check printing and resource utilization

Printing your own checks using QuickBooks also provides the flexibility of on-demand check printing. No more waiting in line at the bank or dealing with delays in check delivery. With QuickBooks, you have the convenience write checks whenever you need them, right from your own office. You just need to configure the correct print settings once and you’re done. This saves valuable time and ensures that you have immediate access to funds for essential business transactions.

Furthermore, printing your own checks allows you to optimize resource utilization. Instead of relying on third-party check services, you can efficiently manage your financial operations in-house by using blank checks. This means you can allocate resources more effectively, ensuring that the right amount of checks are printed when needed. By streamlining the printing process, you can improve operational efficiency and minimize wastage, print now or print later.

One thing to keep in mind with QuickBooks is that they do not allow you to print the check number or the MICR line without the use of third-party check printing software, this is where MultiCHAX comes in.

With MultiCHAX, you can use any blank check or voucher check you want to use to create checks to print in any style or color, even the 3-per-page checks. You can print multiple checks at once. With the proper print setup, you can include one or more signatures, print on regular checks or Z-Fold checks. Want to print checks with your logo? MultiCHAX can do that and more. You just need to select the print settings to select the check stock you want to use.

In conclusion, printing your own checks using QuickBooks is a smart financial move that enhances cost-effectiveness and optimizes resource utilization. The long-term cost savings, convenience of on-demand printing, and improved resource allocation all contribute to financial optimization. By taking control of your check-printing process, you can maximize efficiency, reduce expenses, and allocate resources more effectively. So why not unleash your inner mogul and let QuickBooks be the ink to your financial success?

Robust Security Measures

When it comes to the financial aspects of your business, security is paramount. Creating your own QuickBooks checks offers robust security measures to safeguard your financial transactions, allowing you to preview and print on demand. With the increasing prevalence of fraud and identity theft, it is crucial to have control over your check-printing process. Here, we will explore how QuickBooks ensures accuracy and consistency while seamlessly integrating with other financial tools.

Ensuring Accuracy and Consistency

Printing your own checks using QuickBooks eliminates the risk of human errors that can occur when handwriting checks. QuickBooks automatically fills in the relevant information, such as payee name, amount, and date, from your financial records. This ensures accurate and consistent information on every check, reducing the chances of mistakes or discrepancies.

Additionally, QuickBooks provides customizable check templates that allow you to include your company logo, branding elements, and security features such as watermarks and security codes. These measures not only enhance the professional appearance of your checks but also add an extra layer of protection against counterfeit or altered checks.

Seamless Integration with Other Financial Tools

Another advantage of printing your own checks using QuickBooks is its seamless integration with other financial tools. QuickBooks serves as a centralized platform for managing your finances, including invoicing, expense tracking, and payroll management. By printing checks with QuickBooks, you can ensure that all financial transactions are accurately recorded and reconciled in real time.

Furthermore, QuickBooks integrates with bank feeds, allowing you to easily reconcile your printed checks with your bank statements. This ensures that your financial records are always up to date, providing peace of mind and making tax season less stressful.

The integration with other financial tools extends beyond just reconciliation. QuickBooks enables you to automate payments and set up recurring checks, saving you time and effort. This streamlines your financial processes, reduces manual data entry, and minimizes the risk of errors.

In conclusion, printing your own checks using QuickBooks offers robust security measures, ensuring accuracy and consistency while seamlessly integrating with other financial tools. By eliminating human errors and providing customizable check templates, QuickBooks enhances the security of your financial transactions. Its integration with other financial tools streamlines your processes, improves efficiency, and reduces the risk of mistakes. So why not take control of printing checks with QuickBooks and enjoy the peace of mind that comes with robust security measures?

Reduction in Physical Check Handling

With the increasing prevalence of digital transactions, the use of physical checks may seem outdated. However, there are still several instances where businesses rely on check payments. In this article, we will explore why printing your own checks using QuickBooks makes sense by minimizing risk factors and showcasing a proactive commitment to security.

Minimizing Risk Factors

When it comes to the financial aspects of your business, security is paramount. Printing your own checks using QuickBooks offers robust security measures to safeguard your financial transactions. By taking control of the check-printing process, you minimize the risk of fraud and identity theft. With the ability to print checks in-house, you eliminate the need to share sensitive information with third-party check printing services.

By printing checks from QuickBooks, you ensure accuracy and consistency in every transaction. QuickBooks automatically fills in relevant information such as payee name, amount, and date, reducing the chances of errors or discrepancies. This not only saves time but also provides peace of mind knowing that your financial records are accurate and up to date.

Proactive Commitment to Security

In addition to minimizing risk factors, printing your own checks using QuickBooks demonstrates a proactive commitment to security. QuickBooks offers customizable check templates that allow you to include your company logo, branding elements, and security features such as watermarks and security codes. These measures enhance the professional appearance of your checks and add an extra layer of protection against counterfeit or altered checks.

Furthermore, QuickBooks seamlessly integrates with other financial tools, serving as a centralized platform for managing your finances. This integration ensures that all financial transactions are accurately recorded and reconciled in real time. By printing checks directly from QuickBooks, you can easily reconcile your printed checks with bank statements, reducing the chances of errors and ensuring that your financial records are always up to date.

Beyond reconciliation, QuickBooks enables the automation of payments and recurring check writing, saving you time and effort. This streamlines your financial processes, reduces manual data entry, and minimizes the risk of errors.

In conclusion, printing your own checks using QuickBooks makes sense for businesses looking to minimize risk factors and showcase a proactive commitment to security. By taking control of the check-printing process, you reduce the risk of fraud and identity theft. Additionally, QuickBooks’ customizable check templates and seamless integration with other financial tools enhance the security and efficiency of your financial transactions. So why not take advantage of the robust security measures offered by QuickBooks and enjoy the peace of mind that comes with printing your own checks?

Conclusion

Printing your own checks using QuickBooks offers several advantages and makes perfect sense for businesses looking to minimize risk factors and showcase a proactive commitment to security. By taking control of the check-printing process, you can safeguard your assets, reputation, and stakeholder trust.

Advantages of in-house check printing with QuickBooks

Printing checks in-house using QuickBooks provides numerous benefits. First and foremost, it minimizes the risk of fraud and identity theft. By printing checks internally, you eliminate the need to share sensitive information with third-party check printing services, ensuring the utmost security for your financial transactions.

In addition, the ability to print a check from QuickBooks ensures accuracy and consistency. QuickBooks automatically fills in relevant information such as payee name, amount, and date, reducing the chances of errors or discrepancies. This not only saves time but also instills peace of mind, knowing that your financial records are precise and up to date.

Safeguarding assets, reputation, and stakeholder trust

Printing your own checks using QuickBooks demonstrates a proactive commitment to security and safeguarding your assets. QuickBooks offers customizable check templates that allow you to include your company logo, branding elements, and security features such as watermarks and security codes. These measures enhance the professional appearance of your checks and add an extra layer of protection against counterfeit or altered checks.

Furthermore, QuickBooks seamlessly integrates with other financial tools, serving as a centralized platform for managing your finances. This integration ensures that all financial transactions are accurately recorded and reconciled in real-time. By printing checks directly from QuickBooks, you can easily reconcile your printed checks with bank statements, minimizing errors and ensuring that your financial records are always up to date.

Beyond reconciliation, QuickBooks also enables automation of payments and recurring check printing, saving you time and effort. This streamlines your financial processes, reduces manual data entry, and minimizes the risk of errors.

In conclusion, printing your own checks using QuickBooks is a practical and secure solution for businesses. By taking advantage of the robust security measures offered by QuickBooks, you can minimize risk factors, maintain a professional image, and enjoy the peace of mind that comes with printing your own checks in-house.